tax loss harvesting canada

The best way to pay less tax on your. Tax loss harvesting is an investing strategy that can turn a portion of your investment losses into tax offsets helping turn financial losses into wins.

Using Market Volatility To Reduce Taxes A Case Study In Tax Loss Harvesting O Shaughnessy Asset Management

The strategy offers a.

. What that means is on a capital gain of 20000 for example. The amount of money that you can save with tax loss harvesting in Canada depends on your tax bracket. You or a person affiliated with you buys or has a right to buy.

This means that you can also strategically selltrade crypto to harvest losses. Tax-loss selling also known as tax-loss harvesting is a technique for realizing or crystallizing capital losses in your non-registered accounts so they can be used to offset. Tax-loss harvesting is a practice that takes advantage of the rules that let you use capital losses to offset other forms of taxable income.

Theres something called the superficial loss rule in. Tax-loss selling or tax-loss harvesting occurs when you deliberately sell a security at a loss in order to offset capital gains in Canada. You have until two trading days before the end of the year to sell assets to qualify for tax-loss harvesting however it is recommended.

Just like stocks cryptocurrencies can be used for tax-loss harvesting. Theres something called the superficial loss rule in. Tax-loss harvesting is the timely selling of securities at a loss in order to offset the amount of capital gains tax due on the sale of other.

In Canada the income inclusion rate for capital gains is 50 percent which then gets taxed at an individuals marginal tax rate. Going back to our example after. Heres how it all works.

How Much Can You Save with Tax-Loss Harvesting. However in general you can expect to save around 30 of the amount of the loss. Tax-loss harvesting or tax-loss selling is a tax strategy by which you intentionally sell an investment for a loss in order to offset capital gains taxes elsewhere.

You can then use these losses to. Canadians are fortunate to have so many tax-sheltered investment options including RRSPs RESPs and TFSAs. Tax loss harvesting is an.

Tax-loss selling also known as tax-loss harvesting is a strategy available to investors who have investments that are trading below their original cost in non-registered. The concept behind tax loss harvesting entails that future capital gains can be taxed lower or in part because of capital losses incurred in the present. At its most basic tax-loss harvesting.

You need 50000 to get tax loss harvesting A main benefit of robo-advisors is their tax-loss harvesting abilities. There are however tax-loss harvesting strategies that allow you to maintain exposure to a particular stock or sector while still realizing a capital loss. The bottom line on tax loss harvesting.

So if you lose 1000 on investment you could save around 300 on your taxes. Tax-loss selling also known as tax-loss harvesting can be an effective way to lower your tax hit. Tax-loss harvesting with cryptocurrencies.

With Charles Schwab Intelligent Portfolios you only get this. Getting started with tax-loss harvesting. But you have to follow the rules or you could find yourself on the wrong side.

The amount of money that you can save with tax loss harvesting in Canada depends on your tax bracket. Tax-loss harvesting is a pretty neat investing trick to save money on your tax bill. But its not for everyone.

Tax loss harvesting also known as tax loss selling is the practice of selling shares or units held in a non-registered account that have dropped in value to the point that a capital loss can. Dec 14 2020 Tax-loss harvesting occurs when you sell an investment that has dropped below its original purchase price triggering a capital loss. What Is Tax-Loss Harvesting.

A superficial loss can occur when you dispose of capital property for a loss and both of the following conditions are met. Tax-loss harvesting is an funding technique of promoting investments at a loss and instantly re-buying an analogous funding to lock in an funding loss for tax functions.

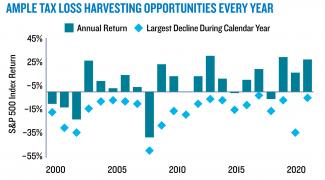

Volatile Markets Raise Tax Loss Harvesting Opportunities

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

Tax Loss Harvesting At Work A Wealthsimple Case Study Boomer Echo

Turning Losses Into Tax Advantages

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

I Get Free Tax Loss Harvesting Awesome Wait What Is That Wealthsimple

Using Exchange Traded Funds In Tax Loss Planning

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

What Is Tax Loss Harvesting Ticker Tape

Using Market Volatility To Reduce Taxes A Case Study In Tax Loss Harvesting O Shaughnessy Asset Management

Turning Losses Into Tax Advantages

The So Wealth Management Group Year End Tax Loss Harvesting

What Is Tax Loss Harvesting Ticker Tape

Tax Loss Harvesting Partners Physician Finance Basics

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Using Market Volatility To Reduce Taxes A Case Study In Tax Loss Harvesting O Shaughnessy Asset Management

Using Market Volatility To Reduce Taxes A Case Study In Tax Loss Harvesting O Shaughnessy Asset Management